In 2019, a small, passionate group set out to challenge the status quo in Indian mid-markets. Our aim was clear: bring global capital to this vibrant yet underserved sector.

Relying on high standards of governance, due diligence, and firsthand intelligence, we went all in, visiting tier 2 cities, factories, and offices of growing companies overlooked by mainstream institutions.

With a strong base to spot opportunities, we launched debt Alternate Investment Funds (AIFs) that connected grassroots entrepreneurs and SMEs to institutional, private wealth, and offshore investors.

Our model delivered, returning capital and promised yields even through the pandemic. With satisfied investors, we scaled up, establishing our expertise in debt solutions.

Our model delivered, returning capital and promised yields even through the pandemic. With satisfied investors, we scaled up, establishing our expertise in debt solutions.

Today, Vivriti Asset Management bridges the gap for SMEs, unlocking credit access while helping investors achieve financial, social, and environmental impact. Aligned with the UN SDGs, our AIFs have raised over US$ 250 million across seven funds, with around US$ 200 million currently under management.

Backed by

"We are specialists. Everything we do, our product, our people, our technology stack, our engagement, our relationships, our distribution & presence… all of it is attuned to our customer segment."

- Vineet Sukumar, CEO

We are not spread thin across categories. Our focus gives us a much precise and nuanced understanding of risk, leading to the market beating performance of our funds.

Nothing beats firsthand intelligence. You will find us in factories, workshops, and offices of growing, feasible companies, often in tier 2 or 3 cities. This reflects directly on the asset quality offered to investors.

Integrity, governance and ethics are inherent to our operations.

We're stocked up on intellectual firepower. The investment teams at Vivriti combine decades of expertise, with a disciplined approach, to deliver consistently, in all market climates.

Everything we are and everything we do is defined by a shared sense of values, a collective vision and an open, collaborative environment.

Ethics guide every decision.

Building trust through openness.

Investor interest comes first, in all that we do.

We're not doing a job, we are on a mission.

Nothing substitutes rigour, sincerity and attention to detail.

Diverse minds are richer and more effective.

Expertise defines us. Our fund managers have rich experience in credit, finance and structured investments, delivering results with precision and innovation.

We're helmed by unique individuals, who combine business acumen and an entrepreneurial spirit with the desire to make a real difference.

Strong governance practices form the foundation of our operations, ensuring transparency, stakeholder protection, and accountability.

Our oversight committee includes an independent Chairman, Director, and Members, ensuring objective decision-making and robust conflict management.

Independent Chair on the Board

Independent Chairman

Independent Member of the Investment Committee

We prioritize timely information sharing, particularly around potential conflicts, to uphold credibility and trust.

Board-approved policies guide our interactions with group companies and related entities, ensuring client-first, independent decision-making.

Our governance framework encourages trust and accountability at all levels, protecting employees who raise concerns.

We align with the best to stay steadfast to our vision.

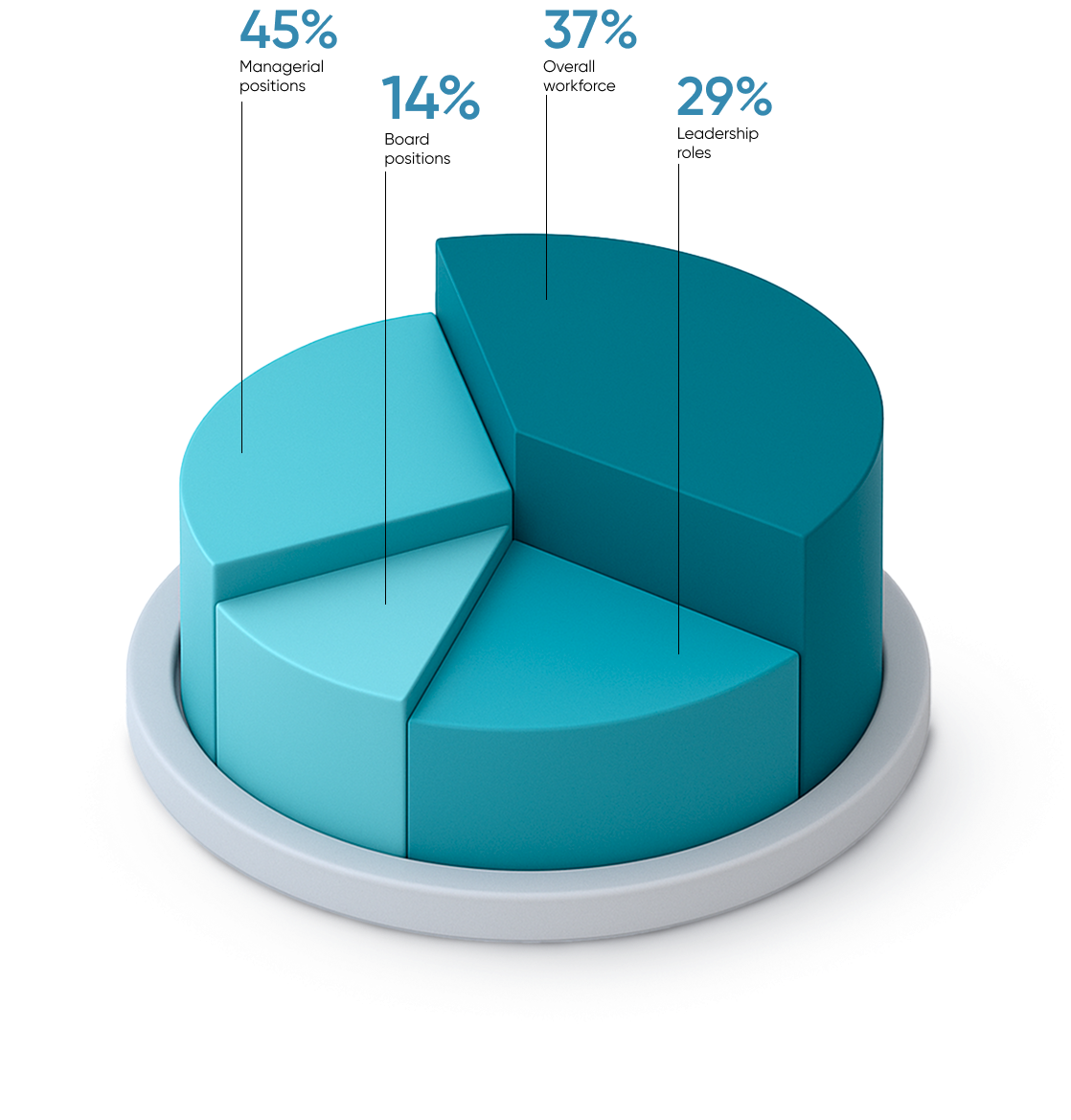

With strong representation of women across all levels, we continue to advance balanced leadership, inclusive decision-making, and employee well-being.

These principles have enabled us to build trust-based relationships with stakeholders and contribute meaningfully to India's credit growth.